FTC Disclosure:This post contains affiliate links.We’re independently supported by our readers and we may earn a commission when you buy through our links.

Table of Contents

Introduction

Duns and Bradstreet (D&B) is a company that provides commercial data, analytics, and insights for businesses. They are best known for their business credit reports and risk management solutions. D&B has been around since 1841 and has extensive data on over 330 million businesses worldwide.

If you run a business, chances are you will encounter D&B eventually. Lenders, suppliers, partners, and potential customers may want to review your D & B business credit report before doing business with you. So, it’s essential to understand what D&B is all about and how it works.

In this comprehensive Duns and Bradstreet review, we will cover everything you need to know about this business credit reporting agency. Read on to learn about D&B’s credit reporting, getting your DUNS number, improving your D&B scores, and whether it’s worth paying for premium D&B services.

Overview of Duns and Bradstreet

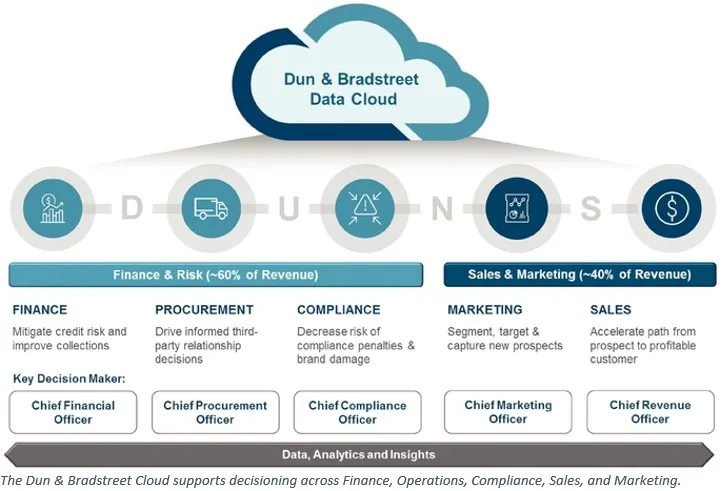

Duns and Bradstreet provides commercial data and insights on businesses worldwide. Some of D&B’s key offerings include:

- Business credit reports – D&B collects data on both public and private companies to build business credit reports. These reports include identifying information, corporate linkages, financial information, payment history, legal events, and D&B proprietary scores.

- DUNS numbers – The Data Universal Numbering System or DUNS number is a unique nine-digit identifier assigned by D&B to each business location. It is akin to a social security number for businesses.

- Business rankings and analytics – D&B offers analytical tools to benchmark and assess business performance. Some examples are financial stress scores, supplier evaluation risk ratings, and growth and risk assessments.

- Sales & marketing data – D&B’s comprehensive database allows customers to research prospects, qualify leads, and enrich CRM systems.

- Third-party risk monitoring – D&B helps assess third-party entities such as suppliers, vendors, partners, and customers for risk management.

- Economic analysis – D&B analyzes macroeconomic trends and forecasts and provides customized market research reports.

How Duns and Bradstreet Collects Data

Duns and Bradstreet obtains data from multiple sources to build its extensive commercial database:

- Government filings include business registrations, corporation filings, and other public records.

- D&B conducts phone surveys with principals of each business to verify facts.

- Web and social media scraping can reveal details on company leadership, revenue, sites, etc.

- Business trade payments and credit data purchased from vendors.

- D&B partners directly with businesses that voluntarily provide financial statements.

- Customer payments of D&B subscribers are tracked to assess payment behavior.

This multitude of data sources allows D&B to offer reasonably reliable and up-to-date information on private and public businesses.

Duns and Bradstreet Credit Reports and Ratings Explained

The D&B business credit report includes several ratings and scores that provide unique insights into a company’s business creditworthiness:

D&B Viability Rating: This is an overall assessment of a company’s probability of going out of business within the next 12 months based on previous payment history and other variables. The Viability score ranges from 1 to 9, with a higher rating indicating a lower risk of failure. A rating of 3 signifies a 1% – 10% risk of failure.

D&B PAYDEX Score: The PAYDEX is a dollar-weighted numerical score based on a company’s payment history with vendors and creditors. It ranges from 0-100. A higher score indicates payments are generally made closer to contract terms, which lowers nonpayment risk. For instance, a PAYDEX of 80 signifies that a company pays its bills an average of 80 days beyond the invoice or contract date.

Commercial Credit Score: The D&B Commercial Credit Score predicts the likelihood of a business failing to pay within the next 12 months. It ranges from 1-100, with lower scores indicating higher risk. The score is based on statistical models similar to consumer credit scores.

Supplier Evaluation Risk Rating: A 1-5 rating of a company’s level of risk when evaluated as a supplier. A 1 rating indicates minimal supplier risk, while a 5 rating suggests high risk. Companies are analyzed based on financial statements, payment history, legal filings, corporate linkages, and other variables.

In addition, the D&B report includes:

- Public filings.

- Corporate family trees.

- Industry ratings.

- Detailed contact information.

- Estimated sales volumes.

- Other useful data.

How to Get a DUNS Number

To obtain a DUNS number for your business, you can request it directly on the D&B website or by phone. The DUNS number is provided for free and typically processed within 1-2 business days.

Some tips on getting a DUNS number:

- Ensure you have your legal business name, address, and federal tax ID.

- You must provide information on company leadership, such as owners, principals, or officers.

- If requesting it online, you will receive an email confirmation with the new DUNS number.

- By phone, a D&B agent will verify details and provide the new number during the call.

- You can also use the D&B mobile app to request a DUNS number quickly.

- Each physical location will be assigned a unique DUNS number.

Once you have your DUNS number, review your D&B business credit file regularly to keep it updated and accurate. It’s also wise to claim and optimize your D&B business profile if it’s available on their website.

How to Improve Your D&B Scores and Ratings

Here are some tips to help improve your D&B credit scores and ratings:

- Pay all bills and obligations on time or early to vendors and creditors. This will boost your PAYDEX score over time.

- Avoid defaults, bankruptcies, liens, lawsuits, and other derogatory events that may lower your scores. Dispute any inaccuracies in your report.

- Increase your business revenue and profits year-over-year. Financial growth and stability can improve rating risk.

- Get trade credit and lines of credit in your company’s name and make payments reliably to build business credit.

- Become a D&B subscriber and PAYDEX data reporter to benefit from reciprocal data sharing.

- Provide your financial statements directly to D&B to present the most positive picture of your finances.

- Link your company to financially strong corporate parents/affiliates if applicable.

- Correct outdated contact information and fill in gaps in your D&B report. Claiming and updating your profile also helps.

With diligent credit management over time, businesses can strengthen their D&B scores and risk ratings. This makes you look more attractive to lenders, suppliers, and B2B partners when they review your business credit report.

Duns and Bradstreet Pricing and Products

D&B offers both free and paid products and services. Many are tailored to specific industries and needs:

- DUNS Number: Free

- Business Credit Reports: $120-$500+ per report, depending on the type of report. Volume discounts are available.

- CreditSignal® Monitoring: $99+/month for ongoing credit file monitoring alerts.

- DNBi Risk Management Software: Contact for a customized quote based on data needs.

- Sales & Marketing Solutions: Contact for a quote based on data licensing requirements.

- Hoover’s Company Profiles: $299+/month for online business profiles database.

- Finance & Risk Management Reports: $295 – $20,000+ for customized business risk assessments.

- Supply Management & Procurement Reports: Risk and supplier analytics reports cost $500 – $1,000.

For most small businesses, obtaining your free DUNS number and monitoring your $120 D&B business credit report a few times a year is sufficient. Usage tends to increase with larger companies relying on D&B data analytics for supply chain risk management and lead generation.

Pros of Duns and Bradstreet

Here are some of the critical advantages of D&B business data:

- Extensive data resources – Over 330 million business records provide widespread commercial coverage.

- Long history – Almost two centuries of business data give unique historical insights.

- Specialized risk assessments – Ratings help identify high-risk suppliers, customers, or partners.

- Business prospecting – Identify target companies that fit your criteria for new sales leads.

- Monitor credit changes – Alerts you to any shifts in your business credit standing.

- Supplier comparisons – Benchmark potential suppliers on risk profiles and ratings.

- Validate business identity – The DUNS number establishes business credit identity.

For large enterprises and government agencies, D&B is a must-have resource for in-depth data on other businesses. Even for small business owners, tapping into D&B’s established business intelligence can be valuable for marketing, finding prospects, qualifying leads, and monitoring credit risk.

Cons of Duns and Bradstreet

D&B does come with some downsides to consider:

- Expensive for small business – Pricing may be cost

Prohibitive for smaller companies with limited need for business reports and ratings.

- Information gaps – D&B depends mostly on public data sources, so private companies with no supplier trade data may have incomplete reports.

- Dispute difficulties – Incorrect or outdated information on your business can negatively impact scores, but disputes can be tedious and lengthy.

- Unverified data – Some D&B data is estimated or modeled rather than sourced directly from the business.

- There are too few score factors. Ratings like PAYDEX are based on limited payment data rather than robust analytics.

- Not widely used – D&B scores don’t carry much weight for credit decisions as standard consumer FICO scores.

- DUNS change issues – Transferring or changing DUNS numbers due to updates like address changes can disrupt business credit profiles.

D & B lacks some of the sophistication of modern data analytics. However, basic business credit reports and risk ratings still provide adequate insights for most use cases. Just supplement with other sources when more rigorous verification is needed.

Is Duns and Bradstreet Worth It for Your Business?

For most small businesses, getting your free DUNS number and occasionally monitoring your D&B business credit report is sufficient to cover basic needs. The paid solutions are most valuable for large enterprises that need robust data for things like:

- Analyzing suppliers, partners, and vendors for risk management.

- Generating targeted sales leads and prospecting new customers.

- Benchmarking competitors using aggregated industry data.

- Building predictive models for credit risk scoring and business failure forecasting.

For anyone needing access to extensive credit data on public and private companies worldwide, D&B’s massive commercial database can prove invaluable despite some limitations. However, smaller businesses may not see enough benefit to justify the cost of premium reports and analytics.

Conclusion

Duns and Bradstreet has provided business credit data for nearly two centuries. Despite its flaws, it remains a go-to resource for universal commercial intelligence used by businesses and government institutions.

Understanding your D&B business credit scores, ratings, and report details allows you to monitor credit risk and improve your business credit standing. While the paid premium products target enterprise-level needs, even small companies can benefit from a free DUNS number and periodic monitoring of their basic D&B business credit file.

So make sure to claim your company’s D&B business credit profile, keep it updated, and check for any inaccurate information that may negatively impact your scores. With its extensive business database, long legacy in commercial data, and ubiquitous adoption, maintaining a presence on Duns and Bradstreet is essential for every business.